Signed in as:

filler@godaddy.com

Signed in as:

filler@godaddy.com

Statistical Learning

Econometrics

Bayesian Analysis

Optimisation

Data Science

Alpha Research

Trading Strategies

Portfolio Construction

Benchmark Replication

Risk Management

Hunt for alpha is existential pursuit for many investment managers. Thousands of tradable assets, multitude of trading platforms and vast amount of data generated real time produces opportunities as well as challenges.

How does one deal with low signal to noise ratio? What makes a trading signal is robust ex-ante? How does one design a robust process for testing and selecting signals? Low signal to noise ratio and over fitting makes alpha research difficult. We apply modern statistical learning techniques to discovery of robust trading signals and design of trading models.

Portfolios are often benchmarked to broad-based indices. In some cases these indices not tradable by construction e.g. inflation. In some cases, the index components are not liquid e.g bond indices. Beta based replication does not always work as it does not account for non-linearities sufficiently well.

We work on replication programs that leverage machine learning and derivative pricing technologies.

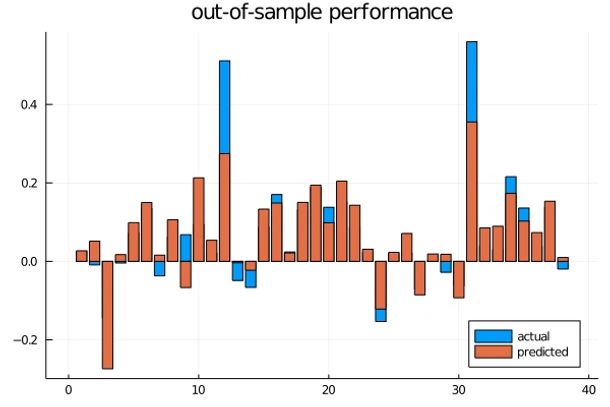

Comparison of out of sample 1 year returns of a popular high yield bond benchmark and a replication using a much smaller and liquid universe compared to the benchmark.

Finance today is an inter-disciplinary field drawing research from applied mathematics, machine learning, economics and computing. We synthesize latest research and leverage modern computing tools and techniques to solve problems for institutional investors.

Bet sizing is as important as selection of assets and trading signals. There are many methodologies depending on investment horizon, objective, asset universe. The optimization procedures involved can be computationally intensive; off-the-box solutions can be unstable. We provide research support, implement models, develop custom software for institutional investors who want to leverage cutting edge research in optimization and finance literature.

Copyright © 2021 Banach Technologies PTE LTD - All Rights Reserved.

think. compute.